Introduction

With Core Exchange, Plaid has taken the guesswork out of building to the FDX standard. +

Introduction

With Core Exchange, Plaid has taken the guesswork out of building to the FDX standard. With our spec, your organization will know exactly which fields are needed to power connectivity to the Plaid Network and be FDX-aligned. By building a Core Exchange API, you’ll enable your customers to seamlessly connect their accounts to over 8,000 applications powered by Plaid, including payment services, budgeting apps, and many more. @@ -14,4 +14,4 @@ This estimated timeline covers the time period for building, testing, and deployment. It doesn't cover your institution's internal review and approval process, migrating existing integrations, or other considerations included in this document.

API flow overview

At a high level, the Plaid network sends your API secure requests for account balance and transaction information.

Security flow

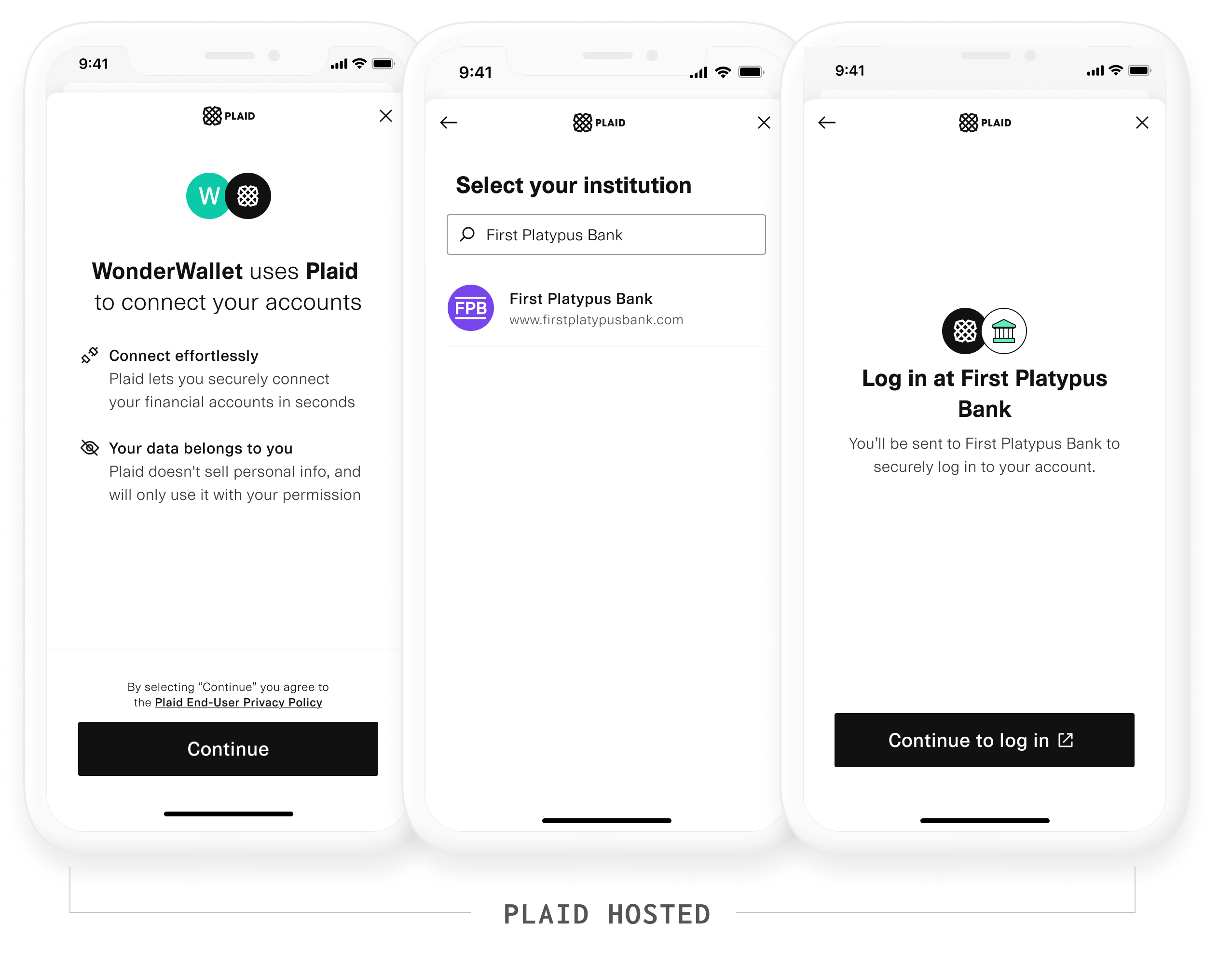

Plaid uses your OpenID Connect security flow to allow your users to connect their financial accounts to their other financial applications.

Plaid requests account information

The first time a user connects their account to the Plaid network, Plaid will send a request for a transaction history period of two years. Afterward, Plaid will send periodic requests for a transaction history period of 14 days. Plaid will also periodically request other account information, including current balances, available balances, and liabilities.

The most common accounts are:

- Deposit accounts

- Investment accounts

- Loan accounts (most commonly

STUDENTLOANandMORTGAGE) - Line of credit accounts (most commonly

CREDITCARD)

Plaid doesn't use Core Exchange for the following:

- Plaid doesn't allow Plaid partners access to your organization's Core Exchange API implementation directly.

Security and privacy

Plaid has established security and privacy processes to help keep your customer's data secure. -See the Plaid Security Portal for more information.